A PFA (Pension Fund Administrator) is to properly enlighten the prospective retiree on the features of the two modes of receiving periodic retirement benefits i.e. Programmed Withdrawal (PW)and Retiree Life Annuity (RLA). Hard copy of the CPS Retirement Pack should be made available to prospective retirees

PFAs are to also advise prospective retirees to check their websites and be acquainted with the CPS Retirement Pack at least 3 months to date of retirement. The pack shall contain features of PW and RLA.

A prospective retiree shall not be compelled by any employer, PFA, RLA Provider, Insurance Broker, Insurance Agent or any person or entity whosoever, to choose either PW or RLA.

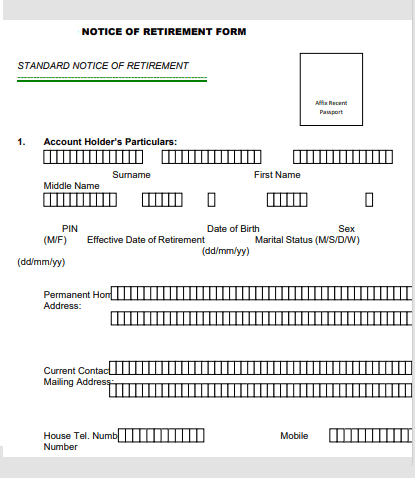

A PFA shall provide and advise a prospective retiree to complete the Standard Notice of Retirement (SNR) form, which shall contain the minimum information as stated in Appendix 1 of this Regulation, to facilitate the processing of retirement benefits.

In the event of demise or missing employee /retiree, the NoK/legal beneficiary shall approach the PFA to complete a Death Notification form (Appendix 2) and apply for the deceased’s death benefits.

The Commission shall provide PFAs with the Standard Retirement Benefit Computation (SRBC) Template, including necessary details such as the Mortality Table, Assumed Rate of Return and Applicable Commission/Fees Chargeable, for computing retirement benefits. This may be subject to review by the Commission from time to time.

A PFA shall enlighten the retiree on how retirement benefits are computed and agree with him/her on the lump sum (within the approved limits) and monthly/quarterly pension. This shall be based on information provided by the retiree and applied on the SRBC Template.

A PFA shall carry out due diligence on submissions made by retirees and confirm that all information provided are correct.

A retiree who opts for PW shall jointly execute the PW Agreement with his/her PFA. The specimen format with the terms and conditions of PW Agreement

The retiree shall endorse a Consent Form, which will indicate the agreed lump sum, monthly/quarterly pension (within the approved limits), periodic pension enhancement (if any) with the PFA. The signing of the Consent Form indicates that the retiree has been properly enlightened and consents to the terms of PW.

The retiree shall not be allowed to access additional lump sum after the payment of initial lump sum, except where there is additional inflow(s) of funds into the RSA from the employer(s).

Notice of Retirement Form

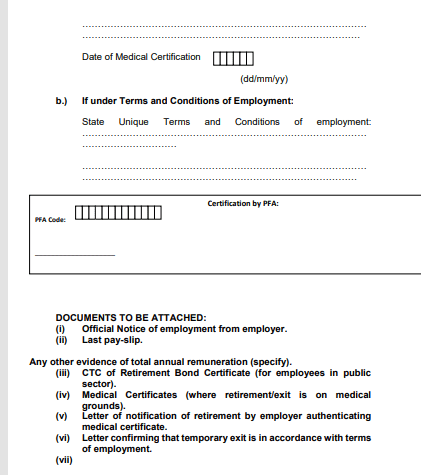

DOCUMENTS TO BE ATTACHED to the form are:

(i) Official Notice of employment from employer.

(ii) Last pay-slip.

Any other evidence of total annual remuneration (specify).

(iii) CTC of Retirement Bond Certificate (for employees in public

sector).

(iv) Medical Certificates (where retirement/exit is on medical

grounds).

(v) Letter of notification of retirement by employer authenticating

medical certificate.

(vi) Letter confirming that temporary exit is in accordance with terms

of employment.

However, where the additional inflow into the RSA of a retiree on RLA is not up to N100,000.00, the amount shall be paid directly into the retiree’s bank account subject to the Commission’s approval.

Where this Regulation does not make any provision on circumstances that relate to accessing/administration of the RSA, the Commission may, from time to time, issue directives or instructions to PFAs/PFCs