The GIFMIS Codes for Ahmadu Bello University, Zaria are:

| SN | REVENUE NUMBER | REVENUE ITEM DESCRIPTION |

| 1 | 1000031081 | TRANSCRIPT PROCESSING FEES |

| 2 | 1000031094 | VERIFICARTION OF RESULT PROCESSING FEES |

| 3 | 1000031104 | STAFF TRAINING FEES |

| 4 | 1000031311 | TENDER PROCESSING FEES |

| 5 | 1000031463 | PAYMENT FOR REPLACEMENT OF LOST CERTIFICATE |

| 6 | 1000034075 | DIRECTORATE OF ACADEMIC PLANNING ACTIVITIES |

| 7 | 1000034088 | STAFF SCHOOL FEES |

| 8 | 1000034114 | CONTRACT REGISTRATION FORM |

| 9 | 1000034208 | LONG VACATION TERM (ACCOMODATION) |

| 10 | 1000034224 | LONG VACATION TERM (REGISTRATION) |

| 11 | 1000034237 | TRANSFER FORM |

| 12 | 1000034253 | IJMB AFFILIATION AND REGISTRATION FEES |

| 13 | 1000034392 | POST-GRADUATE FORMS |

| 14 | 1000034460 | POST-GRADUATE CHARGES |

| 15 | 1000035508 | INSTITUTE OF EDUCATION |

| 16 | 1000035579 | INSTITUTE OF EDUCATION (DIPLOMA REGISTRATION FEES) |

| 17 | 1000035595 | FACULTY OF EDUCATION (AFFILIATION FEES) |

| 18 | 1000035773 | ABU PPRC TRAINING |

| 19 | 1000035867 | UNDERGRADUATE CHARGES |

| 20 | 1000035922 | ABU DLC APPLICATION FORM |

| 21 | 1000035977 | DLC ABU SCHOOL FEES |

| 22 | 1000036138 | ACCOMODATION FEES |

| 23 | 1000042067 | DIPLOMA CHARGES |

| 24 | 1000042070 | INSTITUTE OF ADMINISTRATION |

| 25 | 1000042083 | CENTRE FOR ISLAMIC LEGAL STUDIES |

| 26 | 1000042096 | CENTRE FOR DISASTER RISK MANAGEMENT AND DEVELOPMENT STUDIES |

| 27 | 1000042216 | POST UTME SCREENING |

| 28 | 1000042258 | TRANSFER OF MDA ACCOUNT BALANCE TO CBN |

| 29 | 1000042326 | PAYMENT OF RENT |

| 30 | 1000048744 | OTHER FORMS |

| 31 | 1000051993 | NHIS CAPITATION PAYMENT |

| 32 | 1000052002 | NHIS FEE FOR SERVICE PAYMENT |

| 33 | 1000052015 | NHIS TISHIP PAYMENT |

| 34 | 1000055753 | REFUNDS |

| 35 | 1000056228 | ABU E-LEARNING PROJECT |

| 36 | 1000060120 | COGCC |

Reference: gifmis.gov.ng/grr-number/

GIFMIS

Government Integrated Financial Management Information System (GIFMIS) is an information technology based system for budget management and accounting. It is made by the Federal Government of Nigeria to improve Public Expenditure Management processes, enhance greater accountability and transparency across Ministries, Departments and Agencies.

GIFMIS is designed to make use of modern technologies to help the Government of Nigeria plan and use its financial resources more efficiently and effectively.

It has to do with:

- Budget preparation and execution

- Treasury management and reporting

- General ledger and financial reporting

- Procurement, including Commitments, purchase orders, Maintenance of a central supplier register and Support for e-procurement

- Receipting, Accounts Receivable and Revenue Management

- Payments and Accounts Payable

- Inventory and Stock Control

- Fixed Asset Management

- Project accounting

GIFMIS implementation enables the Federal Government of Nigeria to process financial transactions faster and at a much lower cost. GIFMIS also improves the reliability of management information. This increases the speed at which decisions are taken and services delivered to the general public. It also reduce opportunities for corruption and ensure safety of public resources.

GIFMIS supports public resource management. It’s a targeted anti-corruption initiative, modernising fiscal processes, using better methods, techniques and information technology.

The GIFMIS is aimed at improving the acquisition, allocation, utilisation and conservation of public financial resources using automated and integrated, effective, efficient and economic information systems. The GIFMIS will aid strategic management of public financial resources for enhanced accountability, transparency, cost effective public service delivery, and economic growth and poverty reduction efforts.

The purpose of introducing GIFMIS is to assist the FGN in improving the management, performance and outcomes of Public Financial Management (PFM). The immediate purpose of this project is to enable an executable budget, i.e. a budget which can be implemented as planned by addressing the critical public financial management weaknesses including:

- Failure to enact the budget before the start of the financial year

- The budget is not based on realistic forecasts of cash availability

- Lack of effective cash management – multiple bank accounts within Treasury and MDAs that make effective control impossible; when combined with the lack of cash forecasting this leads to inefficient and unplanned borrowing.

- A lack of integration between different financial management functions and processes, e.g. budget is prepared in a way that makes it difficult to manage the budget execution through the chart of accounts.

Remita

Remita is a payment platform. It enables individuals, businesses, government, and financial institutions to make and receive payments online and offline.

It is owned by SystemSpecs.

SystemSpecs, a software company, was founded by John Obaro in 1991. The company is based in Lagos, Nigeria.

SystemSpecs commenced operations in 1992 as a reseller of SunSystems ERP.

In 2006 it developed Remita. An Account-to-Account Switch.

How to generate RRR (Remita Retrieval Reference)

To generate RRR (Remita Retrieval Reference) you will do the following:

• Enable internet on your phone or computer.

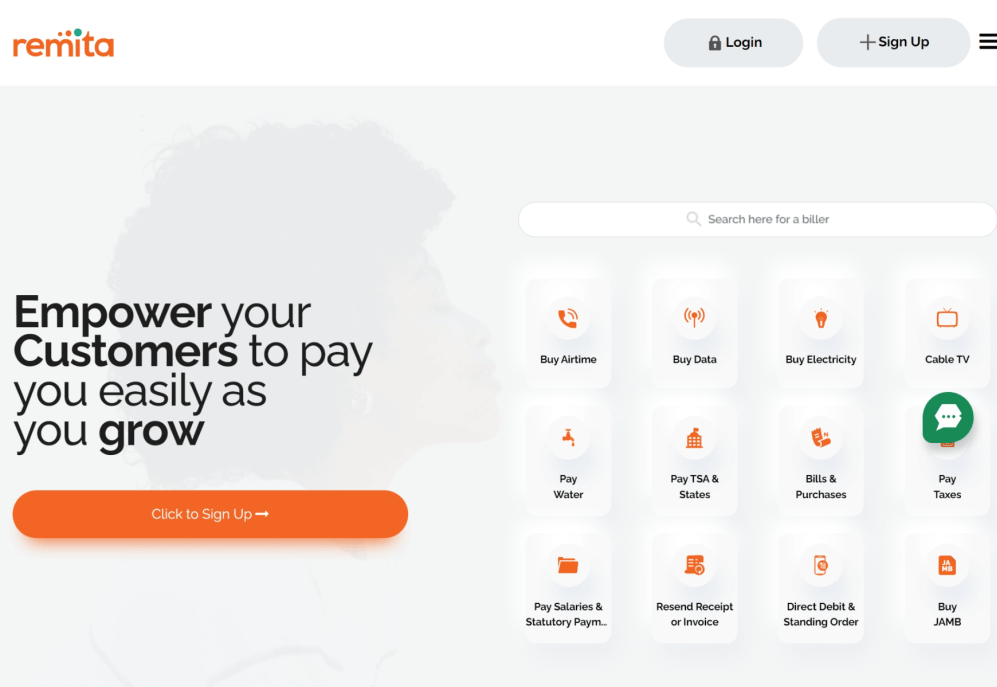

• Visit Remita website: remita.net [> Remita]

• On the website, in the search box for biller, write the name of the MDA (Ministry, Department or Agency) to which you want to make payment

• On the search result, click on the name of the MDA you want to make payment to.

Remita will open the MDA page.

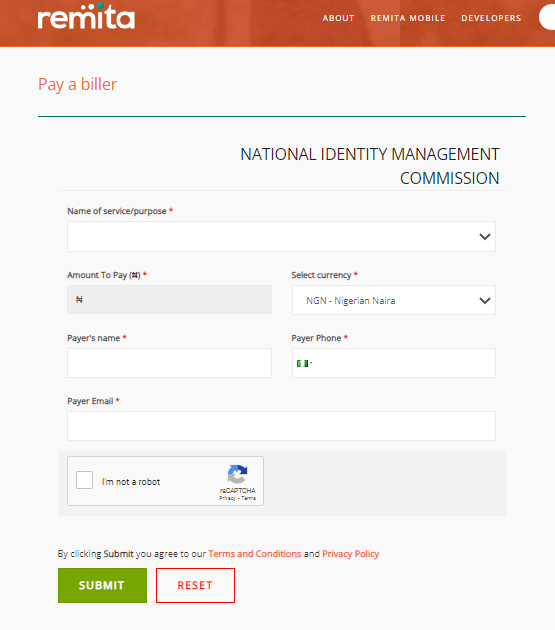

• Click on the type of item you’re paying for under ‘Name of service/Purpose.’

• Fill out the form correctly (choose a payment method, enter details as required)

• Confirm your details and click the ‘I am not a robot’ checkbox.

The system will automatically generate the Remita payment code (the RRR – Remita Retrieval Reference number).

▶ You can now use the code, the Remita Retrieval Reference (RRR), to make payments at the bank or online straight to the MDA you want. You will be given a receipt at the bank hall or via email if you pay online.