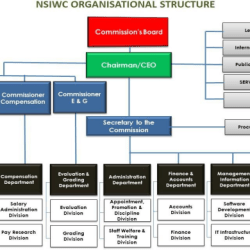

ACT ESTABLISHING THE NATIONAL SALARIES, INCOMES AND WAGES COMMISSION

CAP N72, LFN 1999

NATIONAL SALARIES, INCOMES AND WAGES COMMISSION ACT

(Decree No. 99 of 1993) (23rd August, 1993) (Chapter N72 LFRN 1999 (As Amended))

PART I

Establishment and Membership of the National Salaries, Incomes and Wages Commission

SECTION

(1) Establishment of the National Salaries, Incomes and Wages Commission

(2) Membership of the Commission

PART II

Functions

(3) Functions of the Commission

PART III

Staff of the Commission

(4) Secretary and other staff of the Commission

(5) Application of the Pension Act.

PART IV

Units of the Commission

(6) Operational arms of the Commission and their duties

PART V

Financial Provision

(7) Funds of the Commission

(8) Expenditure of the Commission

(9) Annual estimates, accounts and audits

PART VI

Miscellaneous

(10) Guidelines and enforcement thereof

(11) Penalty for contravention of the guidelines

(12) Level of increase in salaries in trade disputes

(13) Submission of collective agreements to the Commission

(14) Power to obtain information

(15) Independence of the Commission

(16) Offences

(17) Offence by bodies, corporate, etc.

SECTION

(18) Submission of annual report

(19) Power to give directives

(20) Repeal of Cap. 372 LFN 1990

(21) Transitional provisions

(22) Regulations

(23) Interpretation

(24) Short title

SCHEDULE

Supplementary Provisions relating to the Commission

CHAPTER N72

NATIONAL SALARIES, INCOMES AND WAGES COMMISSION ACT

An Act to establish the National Salaries, Incomes and Wages Commission to,

among other things, advise the Federal and State Government on national

income policy.

(1993, No. 99)

(Commencement)

PART I

(23rd August, 1993)

Establishment and Membership of the National Salaries, Incomes and Wages Commission

(1) Establishment of the National Salaries, Incomes and Wages Commission

(1) There is hereby established a body to be known as the National Salaries, Incomes and wages Commission (in this Act referred to as “the

Commission”.

(2) The Commission shall be a body corporate with perpetual succession and a

common seal and may sue and be sued in its corporate name.

(2) Membership of the Commission

(1) The Commission shall comprise a chairman who shall be the chief executive

of the Commission and the following other members, that is –

(a) three full time Commissioners;

(b) the Permanent-Secretary, Office of Establishment and Management

Services of the Presidency;

(c) the Permanent-Secretary, Federal Ministry of Employment, Labour

and Employment:

(d) one representative of the Nigerian Employer’s Consultative

Association:

(e) one representative of the Nigeria Labour Congress: and

(f)

four other persons of proven integrity and relevant experts

(2) The chairman and members of the Commission shall be appointed by the

president.

(3) A member of the Commission shall, subject to the provision of this Act hold

office for a period of five years from the date of his appointment as a

member and shall be eligible for re-appointment for a further term of five

years and no more.

(4) The supplementary provisions contained in the Schedule to this Act shall

have effect with respect to the proceedings of the Commission and the

other matters therein mentioned.

PART II

Functions

(3) Functions of the Commission

The functions of the Commission shall be to –

(a) advise the Federal Government on national incomes policy;

(b) recommend the proportions of income growth which should be utilized for

general wage increase;

(c) inform the Federal government of current and incipient trends in wages and

propose guidelines within which increase in wages should be confined;

(d) keep the Federal Government informed on a continuing basis of movement of

all forms of income and propose guidelines relating to profits, dividends and

all incomes other than wages;

(e) encourage research on wages structures (including industrial, occupational

and regional and any other similar factor), income distribution and household

Consumption patterns;

(f) keep prices under continuous surveillance, interpret price movements and

relate them to other development in the national economy;

(g) propose measures for the regulation of prices and wages in the various sectors of the economy and for the control of hoarding;

(h) encourage and promote schemes for raising productivity in all sectors of the

economy;

(i) establish and run a data bank or other information centre relating to data on

wages and prices or any other variable and for that purpose to collaborate

with data collection agencies to design and develop an adequate information

system;

(j) inform and educate the public on prices, wages and productivity, their

relationships with one another and their inter-play in determining standard of

living and real economic growth;

(k) examine and advise on any matter referred to it by the Federal and State

Governments concerning any of the functions conferred on it by or pursuant

to this Act;

(l) examine, streamline and recommend salary scales applicable to each post in

the public service;

(m) examine areas in which rationalization and harmonization of wages, salaries

and other conditions of employment are desirable and feasible as between

the public and private sectors of the economy and recommend guidelines

which will ensure sustained harmony in work compensation policies in both

the public and private sectors;

(n) examine the salary structures in the public and private sectors and

recommend a general wages framework with reasonable features of relativity

and maximum levels which are in consonance with the national economy;

(o) examine and recommend effective machinery for assembling data on a

continuing basis taken into account changes in the cost of living, productivity

levels, levels of pay in the private sector and other relevant economy data on

which public sector salary and other benefits can be reviewed annually;

(p) examine the current rate of retirement benefit and recommend appropriate

mechanism for periodic review of retirement benefits;

(q) inquire into and make recommendations on any other matters which, in the

opinion of the commission, appear to be relevant to the foregoing and

therefore ought, in the public interest, to be inquired into; and

(r) undertake any other activity which is likely to assist in the performance of the

functions conferred on it by or pursuant to this Act.

PART III

Staff of the Commission

(4) Secretary and other employees of the Commission

(1) There shall be appointed by the President on the recommendation of the

Commission, a Secretary to the Commission who shall not be below the

rank of a Permanent-Secretary in the Civil Service of the Federation.

(2) The secretary shall –

(a) be the accounting officer of the Commission;

(b) assist the Chairman –

(i) in carrying out the day-to-day activities of the Commission; and

(ii) in ensuring that all rules and regulations relating to management

of the human, material and financial resources of the Commission

are adhered to in accordance with the objectives of the Federal

Government; and

(c) carry out such other duties as may be required of him, from time to

time, by the Chairman.

(3) The Commission may appoint such number of other persons to be

employees of the Commission as may deem fit.

(4) The commission may develop and submit to the President appropriate

conditions of service covering remuneration, fringe benefits, pension

schemes and other benefits which would enable it attract and retain high

quality man power.

(5) Application of Pension Act

(1) Service in the Commission shall be pensionable under the Pension Act, and

accordingly, employees of the Commission shall, in respect of their service

in the Commission be entitled to pensions, gratuities and other retirement

benefits as are prescribed thereunder.

(Cap. P4)

(2) Notwithstanding the provisions of subsection (1) of this section, nothing

in this Act shall prevent the appointment of a person to any office on terms

which preclude the grant of a pension and gratuity in respect of that office.

(3) For the purpose of the application of the Pension Act, any power

exercisable thereunder by the Minister or authority of the Federal

Government (not being the power to make regulations under section 23

thereof) is hereby vested in and shall be exercisable by the Commission

and not by any other person or authority.

(4) Subject to subsection (2) of this section, the Pension Act shall in its

application by virtue of the subsection (3) of this section to any office, have

effect as if the office were in the Civil Service of the Federation within the

meaning of the constitution of the Federal Republic of Nigeria 1999.

(Cap. P4. Cap C23)

PART IV

Units of the Commission

(6) Operational arms of the Commission and their duties

(1) The Commission shall have at its discretion, the following operational arms

and agencies, that is:

(a) the Pay Research Unit;

(b) the Incomes Analysis Unit;

(c) the Wages and Productivity Unit;

(d) the Price Intelligence Agency; and

(e) the Job Evaluation and Grading Unit.

(2) The Pay Research Unit shall be responsible to the Commission for

(a) collecting and analyzing data on the cost of living. Productivity, levels of pay in the private sector and such other data as would enable it

determine the extent of adjustment (if any) to be made in wages

structure in the public service;

(b) carrying out such other duties as may be assigned to it, from time to

time, by the Commission.

(3) The Incomes Analysis Unit shall be responsible to the Commission for-

(a) making inquiries into the various aspects of income distribution as

well as changes in the pattern of distribution of income in the form of

wages, profit, rent, dividends and collecting data relative thereto;

(b) conducting investigations relating to interpersonal and regional

distribution of income and collecting data relative thereto;

(c) analyzing profits, rents, dividends and other non wage incomes in

other to enable the Commission determine appropriated] guidelines

relative thereto; and

(d) carrying out such other duties as may be assigned to it from time to

time, by the Commission.

(4) The Wages and Productivity Unit shall be responsible to the Commission

for:

(a) evaluating, on a continuing basis, trends in wages, productivity and

economic growth with a view to providing the Commission with such

information as would enable the Commission determine permissible

increases in wages in the private sector;

(b) where so directed by the Commission, promoting and assisting to

implement schemes for reason productivity in public and private;

(c) carrying out such other duties as may be assigned to it, from time to

time by the Commission.

(5) The Price Intelligence Agency shall be responsible to the Commission for:

(a) studying and interpreting price movements (including re-sale price

maintenance) on a counting basis; and

(b) carrying out such other duties of a similar nature to the foregoing as

may be assigned to it from time to time by the Commission.

PART V

Financial Provision

(7) Fund of the Commission

(1) The Commission shall establish and maintain a fund from which shall be

defrayed all expenditure incurred by the Commission

(2) There shall be paid and credited to the fund established pursuant to

subsection (1) of this section –

(a) such moneys as may, from time to time, be granted or lent to the

Commission by the Government of the Federation or of a State;

(b) all moneys raised for the purposes of the Commission by way of gift,

loan, grant-in-aid, testamentary disposition or otherwise;

(c) all subscriptions, fees and charges rendered or publications made by

the Commission; and

(d) all other assets that may, from time to time, accrue to the

Commission.

(3) The fund shall be managed in accordance with rules made by the President

and without prejudice to the generality of the power to make rules under

this subsection, the rules shall in particular contain provisions-

(a) specifying the manner in which the assets of the fund of the

Commission are to be held and regulating the making of payments into

and out of the fund; and

(b) requiring the keeping of proper accounts and records for the purposes

of the fund in such forms as may be specified in the rules.

(8) Expenditure of the Commission

The Commission may, from time to time, apply the proceeds of the fund

established pursuant to section 7 of this Act to –

(a) the cost of administration of the Commission;

(b) the payment of the salaries, fees and other remuneration, allowances,

pensions and gratuities payable to members of employees of the

Commission.

(9) Annual estimates, accounts and audit

(1) The Commission shall not later than 31 October in each year, submit to the

President an estimate of its expenditure and income during the next

succeeding financial year.

(2) The Commission shall keep proper accounts of the Commission in respect

of each year and proper records in relation thereto and shall cause its

accounts to be audited not later than 6 months after the end of each year

by auditors appointed from the list of auditors and in accordance with the

guidelines supplied by the Auditor-General for the Federation.

PART VI

Miscellaneous

(10) Guidelines and enforcement thereof

(1) The Commission may, from time to time, and shall when so directed by the

President, prepare guidelines on any question relating to wages or other

forms of income or to prices, charges or other sums payable under

transactions of any description relating to any form of property, rights,

services to any description or to returns on capital invested in any form of

property, including dividends in relation to any of its functions under or

pursuant to this Act.

(2) Guidelines prepared pursuant to subsection (1) of this section, shall be

submitted to the President who may direct such action thereon as he may

consider fit in the circumstances.

(3) Where the President directs the enforcement of any restraint or any other

matter. Then it shall be duty of the Commission to implement any such

direction and if it thinks fit, through any of its operational arms.

(4) The Commission shall give public notice, in any manner as it may determine

of any restraint or any other matter requiring to be enforced pursuant to

this section.

(11) Penalty for contravention of guideline

(1) A person who contravenes a guideline issued under the provisions of

section 10 of this Act or regulations made thereunder is guilty of an offence.

(2) A person guilty of an offence under subsection (1) of this section is liable

on conviction to a fine of N10,000 or to imprisonment for a term of 2 years

or to both such fine and imprisonment.

(12) Level of increase in salaries in trade disputes

Notwithstanding anything contained in the Trade Disputes Act, where the

Industrial Arbitration Panel is of the view after arbitration, that a case has been

made for an increase in salaries, the Industrial Arbitration Panel shall then refer the decision as to the level of increase to the Commission for advice.

(Cap. T8)

Industrial Arbitration Panel is of the view after arbitration, that a case has been

made for an increase in salaries, the Industrial Arbitration Panel shall then refer the decision as to the level of increase to the Commission for advice.

(Cap. T8)

(13) Submission of collective agreements to the Commission

Where collective agreements between employers and employees involve increase

wages, salaries and fringe benefits, three copies of the collective agreements shall

be submitted to the Commission for advice.

(14) Power to Obtain information

(1) For the purpose of the efficient dispatch of the functions of the

Commission under this Act, the secretary or any other officer of the

Commission may by notice in writing served on any person in charge of

any undertaking, require the person to furnish in such form as the

secretary or other officer may direct, information on such matter as may

be specified by him.

(2) a person required to furnish information pursuant to subsection (1) of this

section, shall within thirty days from the notice comply with the

requirement.

(15) Independence of the Commission

In the discharge of its duties of advising the Federal and State Government on

national incomes policy and ways of enhancing productivity in both the public and private sectors of the economy and in proposing guidelines on relative prices and incomes, the Commission, shall not be subject to the direction or control of any other authority or person.

(16) Offences

(1) If a person required to furnish information pursuant to section 14 of this

Act fails to furnish the information as required under this section, shall be

guilty of an offence and liable on conviction to a fine of N10,000 or to

imprisonment for a term not exceeding six months or to both such fine

and imprisonment.

(2) If a person, in purported compliance with a requirement to furnish

information as aforesaid, knowingly or recklessly makes any statement

therein which is false in a material particular, shall be guilty of an offence

and liable on conviction to a fine of N10,000 or imprisonment for a term

not exceeding three months or to both such fine and imprisonment.

(3) A person, who willfully obstructs, interferes with, assaults or resists, an

officer of the Commission or abets any other person to obstruct, interfere

with, assault or resist the officer shall be guilty of an of an offence and

liable on conviction to a fine of N10,000.00 or to imprisonment for a term

not exceeding six months or to both such fine and imprisonment.

(17) Offences by bodies cooperate, etc.

(1) Where an offense under this Act is committed by a body corporate, firm or

other association of individuals-

(a) every director, manager, secretary or other similar officer of the body

Cooperate;

(b) every partner or officer of the firm;

(c) every trustee of the body concerned;

(d) every person concerned in the management of the affairs of the

association; and

(e) every person who was purporting to act in any such capacity as foresaid,

shall severally be guilty of that offence and liable to be proceeded against and punished for the offence in like manner as if he himself committed the offence unless he proves that the act or omission constituting the offence took place without his knowledge, consent or connivance.

(2) For the purposes of this section, “director´ in relation to a body corporate

established by or under any enactment or law for the purpose of carrying

on under national ownership, an industry or undertaking or part of an

industry or undertaking, being a body corporate whose affairs are managed

by its members, means a member of that body cooperate.

(18) Submission of annual report

The Commission shall, not later than six month after the end of each year, submit

to the President a report on the activities of the Commission and its dministration

during the immediately preceding year and shall include in such report the audited account of the Commission and auditor’s comment thereon.

(19) Power to give directives

Subject to the provisions of this Act, the President, may give to the Commission

directives of a general nature or relating generally to matter of policy with regard

to the exercise by the Commission of its functions and it shall by the duty of the

Commission to comply with the directives.

(20) Repeal of Cap. 372, LFN 1990

The Productivity, Price and Incomes Board Act if hereby repealed and the Board

established under the repealed Act is hereby consequently dissolved.

(Cap.372, LFN 1990)

(21) Transitional provisions

(1) At the commencement of this Act, the Management services Department

of the Office of Establishments and Management Services and the

operational arms of the Productivity, Prices and Incomes Board located in

(a) the federal Ministry of Finance; or

(b) the Federal Ministry of Employment, Labour and Productivity; or

(c) the Federal Ministry of Commerce, shall cease to exist and their right and obligations shall reside in the Commission established by this Act.

(2) Accordingly, the existing staff of the agencies dissolved by subsection (1)

of this section, shall be deemed to have been absorbed by the commission, so however that –

(a) a staff may opt out of the Commission within sixty days of the coming

into force of this Act; or

(b) the Commission may, on advice, dispense with the services of an

existing staff whose level of competence is adjudged inadequate for coping with the task or the Commission.

(22) Regulations

The President may make regulations generally for the purposes of this Act and

without prejudice to the generally of the power hereby conferred, regulations may-

(a) prescribe the forms to be used for the purposes of this Act;

(b) prescribe or contain such administrative or procedural provisions as appear

to the President expedient in order to facilitate the operation of this Act.

(23) Interpretation

In this Act, unless the context otherwise requires “Chairman” means the Chairman of the Commission; “Commission” means the National Salaries, Incomes and Wages Commission established by section 1 of this Act; “Member” means the member of the Commission and includes the Chairman; “Price” includes a charge of any description; and “Wages” includes salaries, personnel emoluments fringe and retirement benefits

(24) Short title

This Act may be cited as the National Salaries, Incomes and Wages commission Act

SCHEDULE

(Section 2 (4)

Supplementary provision relating to the Commission

Proceedings of the Commission

- (1) The Commission shall meet for the conduct of its business at such time, place and on such day as the chairman may appoint but shall meet not less than twice in a year.

(2) At a meeting of the Commission the chairman shall preside, but in his

absence the members present shall elect one of their member to preside. - The Commission shall have power to regulate its proceeding and may make

standing orders for that purpose and subject to any such standing orders and to paragraph 3 of this schedule, may function notwithstanding-

(a) any vacancy in its membership or the absence of any member; or

(b) Any defect in the appointment of a member; or

(c) that a person not entitled to do so took part in its proceedings. - The quorum at any meeting of the Commission shall be a simple majority of the

member - Where standing orders made under paragraph 2 of this Schedule provide for the Commission to co-opt persons who are not members of the Commission, such persons may attend meetings of the Commission and advise it on any matter referred to them by the Commission but shall not count towards a quorum and shall not be entitled to vote at any meeting of the Commission Committees

- The Commission may appoint one or more committees to advise it on the

exercise performance of its functions under this Act and it shall have power to regulate the proceedings of its committees

Miscellaneous - (1) Any contract or instrument which if entered into executed by a person not being a body corporate would not be required to be under seal, may be entered into or executed on behalf of the Commission by any person generally or specifically authorized in that behalf by the Commission.

(2) Any member of the commission or of a committed thereof, who has a

personal interest in any contract or arrangement entered into or proposed to be considered by the Commission or a committee thereof, shall forthwith

disclose his interest to the Commission or committee, as the case may be, and shall not be entitled to vote on any question relating to such contract or

arrangement. - (1) The common seal of the Commission shall not be used or affixed to any

document except in pursuance of a resolution duly passed at a properly

constituted meeting of the Commission and recorded in the minutes of the

meeting.

(2) The fixing of the seal of the Commission shall be authenticated by the

signature of the chairman or some other member authorized generally or

specifically by the Commission to act for the purpose.

(3) Any document purporting to be a document duly executed under the seal of Commission shall be received in evidence and shall unless the contrary is proved, be deemed to be so executed.

CHAPTER N72

NATIONAL SALARIES, INCOMES AND WAGES COMMISSION ACT

SUBSIDIARY LEGISLATION

No Subsidiary Legislation

Reference: NSIWC. nsiwc.gov.ng /wp-content /uploads /2023/01/ NSIWC- ACT.pdf