Retirees are given two retirement benefit modes: Programmed Withdrawal (PW) and Retiree Life Annuity (RLA). A retiree is required to choose between the two modes by which his/her retirement benefits shall be paid.

What is Programmed Withdrawal?

This is a stream of income paid by a Pension Fund Administrator to a retiree on monthly or quarterly basis determined using a Programmed Withdrawal Template over an expected life time.

What happens to the balance in the Retirement Savings Account (RSA) under PW?

The RSA balance is being re-invested by the PFA to generate more income/funds for the retiree. When a retiree dies, any balance in the RSA will be paid to the named beneficiary(ies).

What is Retiree Life Annuity?

This is a stream of income purchased from a life insurance company with the available RSA balance under the CPS as premium. It provides a guaranteed periodic income (pension) to a retiree throughout his/her life after retirement.

Annuity is guaranteed for ten years. If the retiree dies within the first ten years of retirement, the monthly annuity will be paid to his beneficiary(ies) for the remaining years up to ten years at a present value.

How can Annuity be purchased?

A retiree can buy annuity by remitting his/her available RSA balance as premium to a Retiree Life Annuity Provider (Life Insurance Company) with the commitment to provide the monthly/quarterly annuity payments for life.

Who regulates Retiree Life Annuity?

The Regulations on RLA are jointly issued by the National Pension Commission (PenCom) and the National Insurance Commission (NAICOM).

Can I choose PW and later change to RLA?

A retiree on PW can change to RLA. This can be done after at least 1 year of being on PW.

How can the change in (6) above be effected?

A retiree can request the PFA to transfer his RSA balance to his chosen Retiree Life Annuity Provider (RLA Provider), given the PFA one month notice. Can I change from RLA to PW? A retiree on RLA cannot change to PW. This is because RLA is for life.

Can a retiree on PW change his PFA?

Section 13 of the Pension Reform Act (PRA) 2014 states that a holder of a retirement savings account may not more than once in a year, transfer his account from one PFA to another.

Can a retiree on RLA change his RLA Provider?

A retiree on RLA can change his RLA Provider after at least two years of being with the current RLA Provider with the approval of NAICOM.

What happens where a retiree who is on PW exhausts the balance in his/her RSA?

A retiree whose RSA balance is exhausted may be eligible for the payment of Guaranteed Minimum Pension (GMP) through the implementation of the Minimum Pension Guarantee (MPG).

What is MPG? MPG is an arrangement to provide Guaranteed Minimum Pension to eligible retirees.

Can RLA be exhausted?

The risk having been transferred to the RLA provider, RLA cannot be exhausted.

What is Guaranteed Minimum Pension?

Guaranteed Minimum Pension is the lowest benchmark of pension which an eligible retiree under the CPS should receive as minimum pension.

Where can a retiree on PW take his/her complaint to?

A retiree on PW is expected to take his/her complaint to the PFA for resolution. However, where the retiree is not satisfied with the response of the PFA, he/she can seek the intervention of PenCom.

Where can a retiree on RLA take his complaint to?

A retiree on RLA is expected to take his complaint to the RLA Provider for resolution. However, where the retiree is not satisfied with the response of the RLA Provider, he/she can seek the intervention of NAICOM.

What are the Components of RSA Balance at Retirement?

The RSA balance at retirement is made up of the following:

- Pension Contributions from July 2004 till the date of retirement;

- Accrued right (if any), representing pension and gratuity for services rendered from date of first appointment to 30 June, 2004;

- Investment income generated by the PFA;

- Voluntary contributions (if any);

V. Micro pension contributions (if any); and

vi. Nigeria Social Insurance Trust Fund (NSITF) (if any)

How is the RSA balance utilized at retirement?

At retirement, the balance in the RSA of a retiree, after the payment of lumpsum and pension arrears (if any), is used to procure an annuity for life of the retiree or a programmed withdrawal over the expected life span of the retiree.

What percentage of the RSA balance can a retiree take as lumpsum? There is no fixed percentage for lumpsum payable to a retiree. Lumpsum is determined using the RSA balance, age, gender and final salary of the individual retiree. However, the retiree can choose between a zero lumpsum and a maximum lumpsum calculated using the PW template before the purchase of either PW or RLA.

How does lumpsum affect the PW payout of a retiree?

There is an inverse relationship between the amount paid out as Lumpsum and periodic benefit payout. Where a retiree receives a maximum allowable lumpsum, he shall be entitled to the minimum monthly/quarterly pension and vice versa.

How does lumpsum affect RLA payout of a retiree?

The higher the lumpsum received the lower the available RSA balance for the premium, therefore lower monthly/quarterly annuity and vice versa.

How is periodic pension determined?

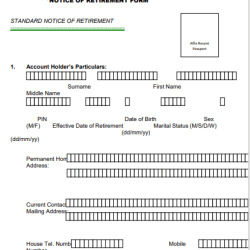

Periodic pension (Monthly or quarterly pension) is determined using the following individual retiree’s data: i. Age at Retirement ii. Gender iii. RSA Balance iv. Annual Total Emolument (ATE) v. Retiree’s choices

Does the CPS allow a retiree to withdraw the entire balance in his/her RSA at once? Only retirees with RSA balance of N550,OOO.OO and below are allowed to withdraw their RSA balance at once subject to PenCom’s review from time to time.

Can I use my RSA balance as collateral for loan?

Pension fund asset cannot be applied for loans or credits or as a collateral for any loan taken by the holder of the RSA.

How and when can an RSA holder access his/her RSA?

The balance in the RSA can be accessed at retirement or on attaining the age of 50 (whichever is later), at death of the RSA holder or at disengagement from employment before the age of 50 years. Where the RSA holder is less than 50 years of age he can withdraw 25% of his RSA balance after 4 months of job loss.