The functions of National Salaries, Incomes and Wages Commission (NSIWC) are:

(a) advise the Federal Government on national income policy;

(b) recommend the proportions of income growth that should be utilized for a general wage increase;

(c) inform the Federal Government of current and incipient trends in wages and propose guidelines within which increase in wages should be confined;

(d) keep the Federal Government informed on a continuing basis of movements of all forms of income and propose guidelines relating to profits, dividends, and all incomes other than wages;

(e) encourage research on wage structure (including industrial, occupational and regional, and any other similar factor), income distribution, and household consumption patterns;

(f) keep prices under continuous surveillance, interpret price movements and relate them to other developments in the national economy;

(g) propose measures for the regulation of prices and wages in the various sectors of the economy and the control of hoarding;

(h) encourage and promote schemes for raising productivity in all sectors of the economy;

(i) establish and run a data bank or other information center relating to data on wages and prices or any other variable and for that purpose collaborate with data collection agencies to design and develop an adequate information system;

(j) inform and educate the public on prices, wages, and productivity, their relationships with one another, and their interplay in determining standards of living and real economic growth;

(k) examine and advise on any matter referred to it by the Federal and State Governments concerning any of the functions conferred on it by or pursuant to this Act;

(l) examine, streamline and recommend salary scales applicable to each post in the public service;

(m) examine areas in which rationalization and harmonization of wages, salaries, and other conditions of employment are desirable and feasible between the public and private sectors of the economy and recommend guidelines that will ensure sustained harmony in work compensation policies in both the public and private sectors;

(n) examine the salary structures in the public and private sectors and recommend a general wages framework with reasonable features of relativity and maximum levels which are in consonance with the national economy;

(o) examine and recommend effective machinery for assembling data on a continuing basis taking into account changes in the cost of living, productivity levels, levels of pay in the private sector, and other relevant economic data on which public sector salary and other benefits can be reviewed annually;

(p) examine the current rate of retirement benefits and recommend an appropriate mechanism for periodic review of retirement benefits;

(q) inquire into and make recommendations on any other matters which, in the opinion of the Commission, appear to be relevant to the foregoing and therefore ought, in the public interest, to be inquired into; and

(r) undertake any other activity which is likely to assist in the performance of the functions conferred on it by or pursuant to this Act.

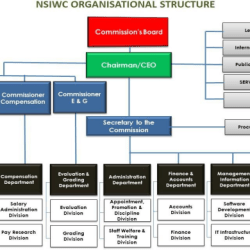

The National Salaries, Incomes and Wages Commission (NSIWC), established by Decree No. 99 of 1993—now recognized as Cap N72 in the Laws of the Federation—was created to oversee and address various aspects of compensation within Nigeria’s Federal Public Service.

NSIWC’s core functions encompass handling remuneration-related matters, administering the National Minimum Wage, reviewing Federal Public Service pensions, conducting research into public service pay structures, and managing comparability surveys and salary administration regulations across the country.

Reference: NSIWC. nsiwc.gov.ng /wp-content /uploads /2023/01/ NSIWC- ACT.pdf