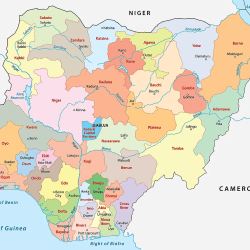

Nigeria has 19 PFAs (Pension Fund Administrators) namely:

- Access Pensions Limited

- ARM Pension Managers Limited

- Crusader Sterling Pensions Limited

- FCMB Pensions Limited

- Fidelity Pension Managers Limited

- Guaranty Trust Pension Managers Limited

- Leadway Pensure PFA Limited

- Nigerian University Pension Management Company (NUPEMCO)

- NLPC Pension Fund Administrators Limited

- Norrenberger Pensions Limited

- NPF Pension Managers Limited

- OAK Pensions Limited

- Pensions Alliance Limited

- Premium Pension Limited

- Radix Pension Managers Limited

- Stanbic IBTC Pension Managers Limited

- Tangerine APT Pensions Limited

- Trustfund Pensions Limited

- Veritas Glanvills Pensions Limited

While majority of the PFAs are owned by profit oriented companies some PFAs have certain institutions as founders. While Trustfund Pensions Limited is owned by NLC (Nigeria Labour Congress), NPF Pension Managers Limited has Nigeria Police as founder.

More on Pension Fund Administrators (PFAs)

Pension Fund Administrators (PFAs) manage and invest pension funds on behalf of employees who are registered under the Contributory Pension Scheme (CPS). This system, regulated by the National Pension Commission (PenCom), aims to provide workers with financial security after retirement.

The Contributory Pension Scheme requires pension funds to be privately managed exclusively by licensed Pension Fund Administrators (PFA). The main functions of the PFA are to open Retirement Savings Account (RSA) for employees; invest and manage pension fund assets; payment of retirement benefits and accounting for all transactions relating to the pension funds under their management.

PFAs are crucial in managing retirement funds, offering investment solutions, and ensuring retirees receive adequate benefits. Whether in Nigeria or other countries with similar pension schemes, PFAs operate within a regulated environment to safeguard pension contributions and help individuals plan for a financially secure retirement.

PenCom considers applications for license to operate as a PFA from entities that fulfil the requirements as enshrined in Section 60 of the PRA 2014. Prior to the issuance of an operating license, the PFA must be a limited liability company whose sole object is the management of pension fund assets. The PFA must also satisfy the Commission that it has the professional capacity to manage pension funds and administer retirement benefits