In 1991, the Bank s and Other Financial Institutions Act (BOFIA) formerly BOFI was promulgated to replace the CBN Act of 1958 and the Banking Decree of 1969 (including later amendments). The policy brought the non-bank financial intermediaries under the supervision of Central Bank of Nigeria.

Nigerian Inter-Bank Settlement System:

In March 1993, the Nigerian Inter-Bank Settlement System (NIBSS) was incorporated to enhance the speed and efficiency of the national clearing system.

National Clearing System Re-Visited:

In January 1995, a revised clearing rule became operational to facilitate effective clearing of financial instruments and shorten the period of clearing. Consequently, inter-state cheque clearing time was reduced from 21 days to 15 days, while intra-state clearing has been reduced from 12 days to 9 days.

Development Stocks:

The first development stock was issued in 1946. Central Bank of Nigeria took the responsiblity of issuing stock at its inception. The Lagos Stock Exchange (now Nigerian Stock Exchange) was set up in 1961 to take over transactions in the stocks.

International Monetary Fund:

The International Monetary Fund was established in 1945 to promote the health of the world economy with 29 countries signing the Articles of Agreement. Nigeria joined the IMF in 1961,which now has 184 members with its headquarters in Washington D.C., USA.

Structural Adjustment Programme (S.A.P.):

Introduced in June 1986, the Structural Adjustment Programme was introduced after a public debate on IMF loan conditionality. It was aimed at re-structuring the productive base of the economy and promoting non-inflationary economic growth.

Indigenous Banking in Nigeria:

The story of indegenous banking in Nigeria began with the establishment of the National Bank of Nigeria Limited in February 1933.

NEEDS:

National Economic Empowerment and Development Strategy was developed by the National Planning Commission, then headed by Prof Charles Soludo. It was endorsed by the Federal Executive Council of Nigeria as a poverty-alleviating strategy. The aim of the scheme was to meet the Millennium Development Goals of curbing the menace of poverty in Nigeria and bringing it to the barest minimum by the year 2015.

Paris Club of Creditors:

The club represents only government guaranteed creditors. Members include the United States of America, United Kingdom, Germany, France and Canada, who guarantee the export activities of their nationals. When the recipient nation s government is unable to pay the equivalent of the imports domestic currency cover, it becomes government debt owed to creditor nations. The first Paris Club meeting was held in 1956.

West African Currency Board:

The West African Currency Board was established in 1912 to retain the services of Bank of British West Africa. It set up four centres in Lagos, Accra, Freetown and Barthurst (now Banjul).

First Governor of CBN:

Mr. Roy Pentelow Fenton was appointed the first and the only expatriate Governor of Central Bank of Nigeria. He served from July 24, 1958 to July 24, 1963.

MANPOWER DEVELOPMENT:

Mr. Graham William Keep was appointed the first and the only Expatriate Deputy Governor of Central Bank of Nigeria, from January 27, 1959 to January 26, 1962.

BOARD OF DIRECTORS:

The Management of the CBN is placed under a Board of Directors which is responsible for the Policy and General administration of the Affairs and Business of the Bank.Under the original statute,the Board was composed of the Governor as Chairman,a Deputy Governor and Five other Directors all of whom were appointed by the Federal Government.

POLICY MAKING ORGAN:

The Board of Directors is responsible for formulating the Monetary/Credit and Exchange rate policy proposals for the approval of the Federal Executive Council and for complementing approved policy guidelines.

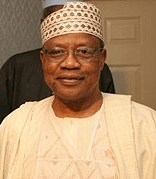

First Indigenous Governor of CBN:

Alhaji Aliyu Mai Bornu was the first Nigerian Governor of the Central Bank of Nigeria from July 25, 1963 to July 31st, 1967.

The Cowry:

The Cowry has, for centuries, served our people as an important form of currency. In 1860 the following system was in use: 40 Cowries formed a “String”; 50 Strings made a “head” and 10 heads comprised a “bag”. In Lagos in 1865 one bag of 20,000 shells was exchanged for one or two English Pounds.

Agric Credit Guarantee Scheme:

The Agricultural Credit Guarantee Scheme (ACGS) was established in 1977, under the management of the Central Bank of Nigeria. The scheme was designed to encourage banks to increase lending to the agricultural sector by providing guarantee against inherent risks.

Central Banking:

The earliest known bank of issue is the Riksbank of Sweden (1656). Modern central banking started with Bank of England (1694). Central Bank of Nigeria began operations in 1959.

Federal Ministry of Finance:

The Federal Ministry of Finance (FMF) advises the Federal Government on its fiscal operations and collaborates with the Central Bank of Nigeria (CBN) on monetary matters. Before 1991, the responsibility for the supervision and licensing of banks was shared between FMF and CBN until 1991 when CBN became the sole authority.

London Club of Creditors:

These are mainly uninsured and unguaranteed debts extended by commercial banks to nationals of debtor nations. Members of the club are commercial banks mainly in industrialized countries. The first London club meeting was held in 1976 to discuss re-payment and conclude re-structuring agreements.

Operation Feed the Nation (O.F.N.):

Operation Feed the Nation was introduced by the federal military government headed by General Olusegun Obasanjo in 1979.It had the specific focus of increasing food production on the premise that availability of cheap food would ensure a higher nutrition level and invariably lead to national growth and development.OFN lasted till the civilian government of Alhaji Shehu Shagari in 1979.

Evolution of Departments:

At inception, the organisational structure of the CBN was understandably simple consisting of two departments, namely, the General Manager’s and the Secretary’s Departments, with the appropriate division of labour as then percieved. The General Manager’s Department was responsible for all the Department banking, currency issues, debt management and other operational functions of the bank while the Secretary’s Department handled the administrative and staff matters, carried out some research into the economic and financial conditions, and collected and analysed relevant statistics for policy formulation.

Appointments:

The Governor and the Deputy Governor are appointed for five years while the other Directors are appointed for three years.All board members are eligible for reappointment.

PHYSICAL EXPANSION:

The CBN former headquarters in Marina Lagos was opened and began full operations in banking and currency activities only.

PHYSICAL EXPANSION:

Later, Benin, Kaduna, Jos, Maiduguri, Calabar, Ilorin and Sokoto branches were opened

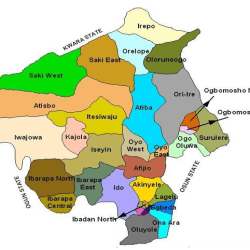

Central Bank of Nigeria, Ibadan Branch:

In the year 1965, The Central Bank of Nigeria,Ibadan Branch was opened for business.It was the third Central Bank office that was established and it brought to 4, the number of Central Bank offices in Nigeria at that time.

Central Bank of Nigeria, Kano Branch:

In 1962,the first Central Bank Branch was established in Kano and opened for business in the same year.This brought to 2, the number of Central Bank offices in Nigeria at that time.

Central Bank of Nigeria, Port-Harcourt Branch:

In 1964,Port-Harcourt Branch was opened for business.It was the second branch that was established by the CBN. It brought to 3, the number of Central Bank Offices in Nigeria at that time.

Central Bank of Nigeria, Enugu Branch:

In the year 1966, The Central Bank of Nigeria Branch in Enugu was opened.It was the fourth Central Bank Branch that was established, bringing to 4, the number of Central Bank offices in Nigeria at that time.

Dr Clement Nyong Isong:

Dr. Clement Nyong Isong was appointed the second Nigerian Governor of Central Bank of Nigeria, from August 15, 1967 to September 22nd, 1975. He also served as the Governor of the old Cross River State.

ORGANISATION AND GROWTH:

In March, 1970, the Board of Directors employed the services of W.H. Rozell (Junior), a consultant, to, among other things, review the existing structure and size of the Bank Departments. In the same year, Rozell proposed a new organisational structure for the CBN.

Mallam Adamu Ciroma:

Mallam Adamu Ciroma was appointed the third Nigerian Governor of the Central Bank of Nigeria, from September 23rd, 1975 to June 27th, 1977. He later served as the Minister of Finance in the first Obasanjo democratic administration

ORGANISATION AND GROWTH:

In 1978, the size of the Board of Directors was increased from 7 to 13, through the recommendations of McKinsey International Incorporated, a UK-based consultant firm.

Guidelines for Licensed Banks:

In 1990, the CBN introduced a set of Prudential guidelines for licensed banks which were complimentary to the capital adequacy requirement and statement of accounting standards. The guidelines spelt out the criteria to be adopted by banks in classifying non-performing loans.

Magnetic Ink Character Recognition:

The Magnetic Ink Character Recognition (MICR) which is an automated system for sorting cheques and other financial instrumenTS. This facility came into effect in the early part of 1995.