The Integrated Payroll and Personnel Information System (IPPIS) is a key initiative by the Nigerian government to modernize and streamline payroll and employee record management for Federal Government employees. Designed to increase transparency, accountability, and efficiency, IPPIS serves a number of critical functions for federal agencies, government ministries, and employees alike. This article explores the core functionalities of IPPIS, its benefits, and how it contributes to Nigeria’s drive towards efficient governance.

Purpose and Importance of IPPIS

Launched to mitigate the financial and administrative discrepancies within Nigeria’s public sector, IPPIS serves as a centralized payroll system that tracks and manages the payment of salaries, deductions, and employee records. It simplifies payroll processes, eliminates ghost workers, and ensures every federal employee receives their entitled wages promptly. By automating payroll and other financial transactions, IPPIS reduces the risks of corruption and improves budgetary accuracy.

Management of FGN Employee Records

One of IPPIS’s fundamental roles is managing employee records for Nigeria’s Federal Government, encompassing a wide range of data, from employment history to individual salaries. This centralized database enables federal agencies to maintain an updated record of their workforce, which is essential for policy implementation and effective management.\

- Employee Enrollment into IPPIS: Newly hired employees go through an enrollment process, which includes verification, documentation, and data entry to ensure that their personal information, position, and salary grade are correctly represented in the IPPIS system.

- Updates and Record Maintenance: Any changes in an employee’s status—promotions, transfers, leaves of absence, or retirement—are routinely updated within the IPPIS system, maintaining data accuracy for effective personnel tracking.

Payment of Salary and Wages to FGN Employees

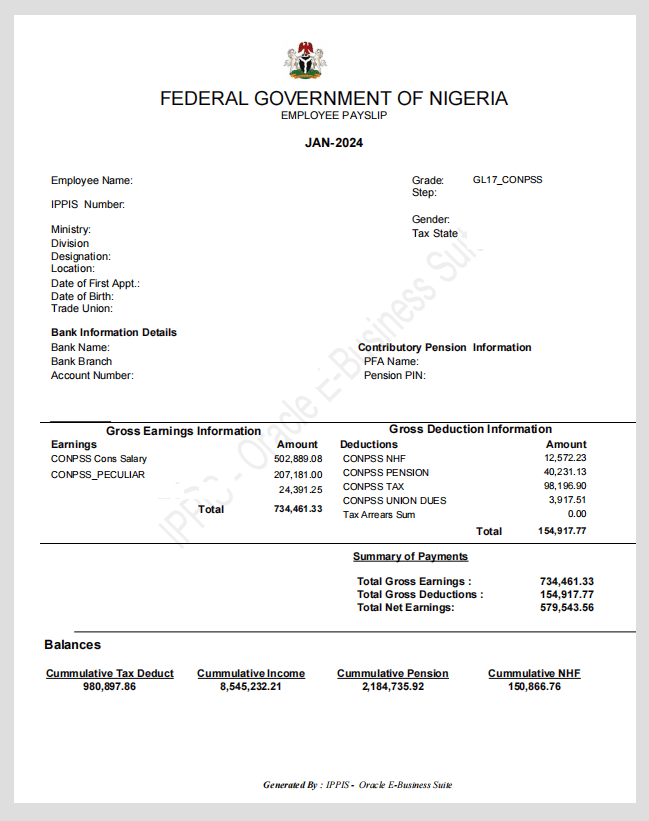

The IPPIS system ensures that every federal government employee receives a consistent, accurate payment on a designated schedule. Salaries are processed in alignment with government pay scales, ensuring compliance with federal wage standards and quick resolution of any discrepancies.

- Salary Calculation and Distribution: IPPIS automates the calculation of monthly wages, taking into account each employee’s grade, position, and authorized deductions. By standardizing salary distribution, IPPIS prevents human error and reduces payroll processing times.

- Addressing Salary Delays and Issues: The IPPIS platform has mechanisms to handle payroll complaints and address delayed payments, working towards resolving discrepancies and ensuring employees’ satisfaction with the payroll process.

Deductions of Taxes and Other Payments

To ensure compliance with Nigerian tax laws, IPPIS systematically calculates and deducts income taxes for each employee. Additionally, other essential deductions such as pensions, health insurance contributions, and loan repayments are managed under the IPPIS framework.

- Tax Deduction Procedures: Based on income brackets and tax laws, IPPIS calculates the appropriate tax deduction for each employee, ensuring federal tax compliance and minimizing discrepancies.

- Other Payroll Deductions: Deductions for pensions, the National Health Insurance Scheme (NHIS), and other mandatory contributions are seamlessly integrated within the payroll system, ensuring accurate and timely deductions for each employee.

Remittance of Payroll Deductions to Third Parties

Beyond calculating deductions, IPPIS is responsible for transferring these amounts to respective third-party entities, such as tax authorities, pension funds, and health insurance providers. This function is crucial to maintain the integrity of the payroll system and fulfill the government’s financial obligations.

- Ensuring Accuracy in Remittance: To prevent discrepancies, IPPIS ensures the precise allocation of each deduction, regularly auditing its remittance processes to avoid errors that could affect employees or third-party institutions.

- Collaboration with Third-Party Agencies: IPPIS maintains close relationships with third-party organizations like pension funds and insurance companies, ensuring that contributions are accurately channeled to benefit the employees.

IPPIS Impact on Transparency and Accountability

The IPPIS system has introduced a new level of transparency in payroll management by eliminating ghost employees and providing a single source of truth for federal payroll data. This initiative helps the government allocate resources more effectively, reducing payroll fraud and misuse of funds.

Challenges Faced by IPPIS

Despite its benefits, IPPIS encounters challenges, including resistance to system adoption, technical issues, and infrastructure limitations in remote areas. Addressing these challenges is critical to achieving the government’s goals for efficient and transparent payroll management.

Benefits of IPPIS for Federal Employees

Federal employees benefit significantly from the IPPIS system, as it ensures timely payment of salaries, simplifies the deduction process, and minimizes errors in payroll. Additionally, the system’s centralized nature helps employees track their contributions and deductions, providing clarity and peace of mind.

- How do employees enroll in IPPIS?

- Federal employees are enrolled through their respective agencies, which submit the necessary information to the IPPIS team for verification and data entry.

- How are salary payments processed?

- IPPIS calculates salaries based on employee records, and payments are disbursed directly into employees’ bank accounts.

- What if an employee has an issue with their salary?

- Employees can report payroll issues to their HR department or directly to the IPPIS help desk for resolution.

- How are taxes deducted through IPPIS?

- IPPIS calculates tax deductions based on the Nigerian tax laws applicable to each employee’s earnings.

- Does IPPIS handle deductions for loans?

- Yes, IPPIS can incorporate authorized loan deductions into the payroll system to ensure timely repayments.

- What’s the role of IPPIS in remitting deductions?

- IPPIS remits deductions like taxes, pensions, and health insurance contributions directly to respective third-party organizations, ensuring prompt and accurate payments.